The oil market continues to surprise, with WTI apparently firmly above $60, a level that could be equated with the pre-pandemic norm (as norm as any oil price can be, which admittedly isn’t very). Considering the global economy remains fragile with numerous areas still suffering badly from the pandemic, including Europe, source of 15% of world oil demand (in normal times), inventories remain adequate and spare crude production capacity is still near thirty year highs, such price levels might appear unjustified.

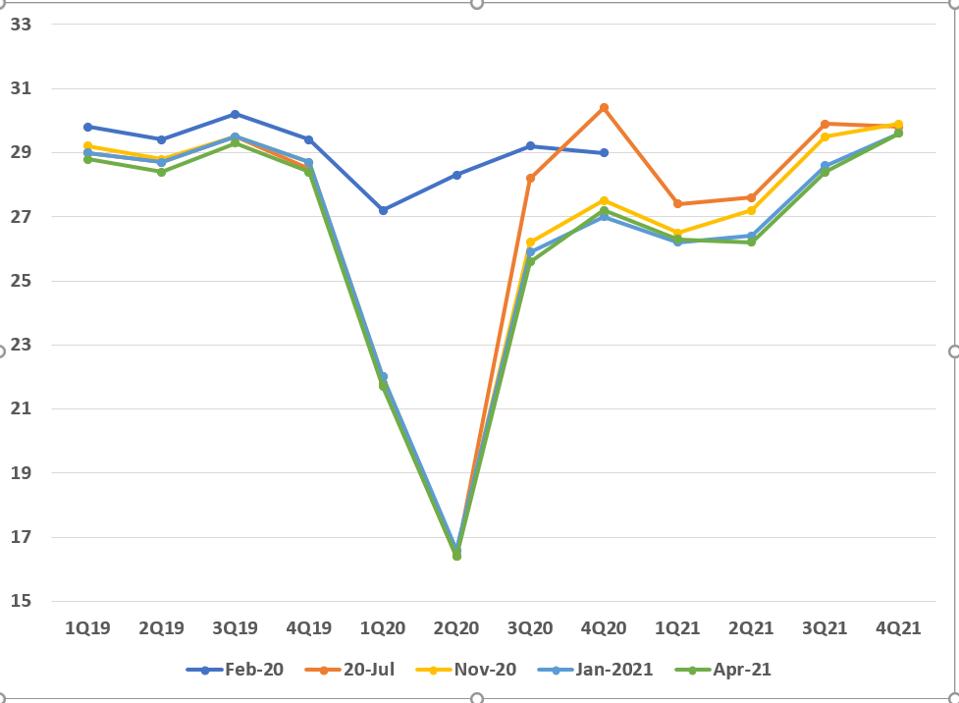

Assuming this isn’t just a financial stimulus driven asset bubble (which is certainly a factor), it would seem that markets are watching the combination of recovering demand (vaccine rollout) and falling inventories. In reality, the IEA has lowered it’s expectations for the ‘call-on-OPEC plus stocks’ in recent months, largely reflecting the impact of covid19 surges in a number of countries. (Figure below)

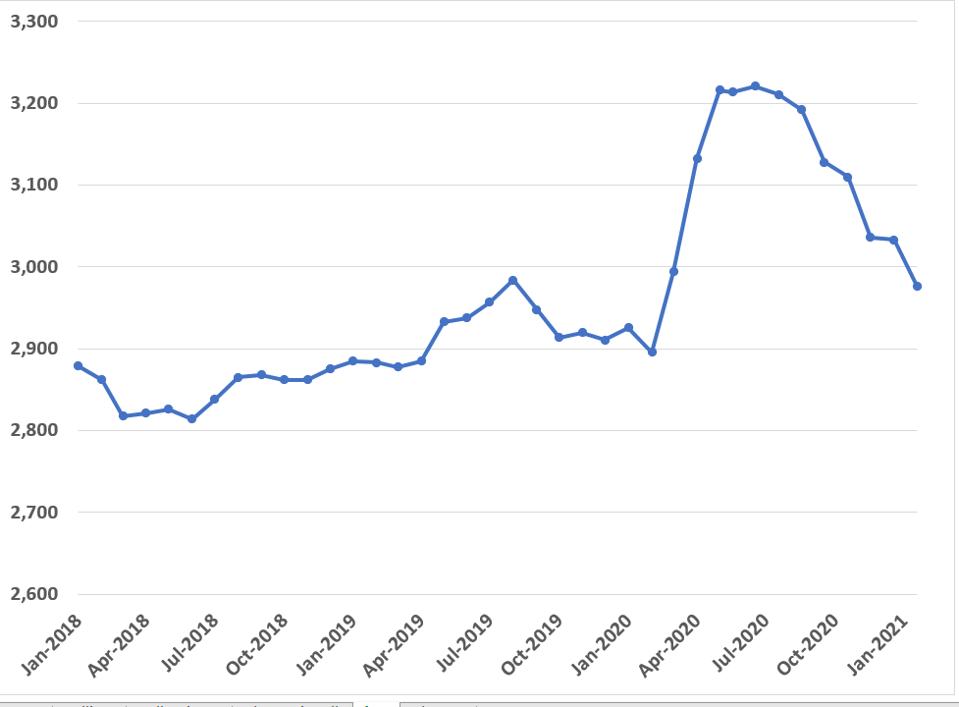

Perhaps more important to traders, the IEA’s latest Oil Market Report estimates that February OECD inventories fell by nearly 2 mb/d, one of the sharpest changes in years, as the figure below shows. Given the likely drop in March, especially due to the Saudi voluntary 1 mb/d cut in production, it is entirely possible that inventories, in absolute terms, are close to normal. However, since demand is still about 5% lower than pre-pandemic levels, the end-February estimates would be more than 100 million barrels too high.

The above figure alone serves as evidence of the good job OPEC+ have done in managing the pandemic-driven oil market collapse, which is historically the primary role of cartels—referred to as ‘recession cartels’ when employed in various industries. For those who hate OPEC (and probably these days that’s only the financial officers of media whose reporters are sent to cover frequent meetings), this goes a long way to showing the value of such a group.

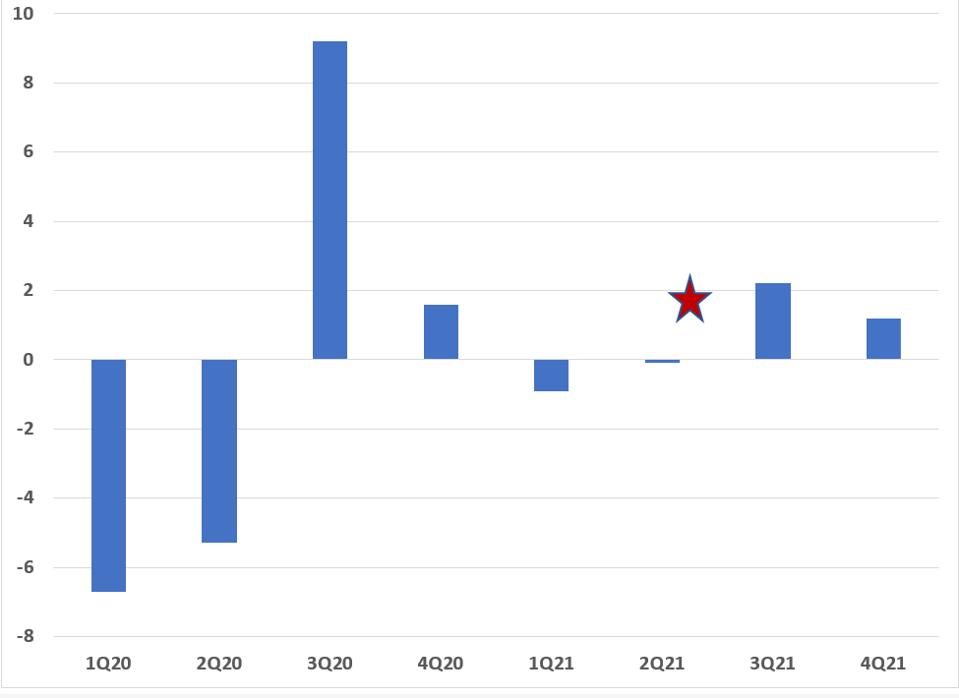

And the market is clearly expected to tighten, with demand rising faster than non-OPEC production, meaning (by IEA estimates), the need for crude in the second half of 2021 will grow by 5.5 mb/d (figure below; the star indicates the planned OPEC+ increase from May to July). This is far beyond any normal increase, again, the times being far from normal, and might suggest that prices could surge further in the second half. Except that OPEC+ production remains about 7 mb/d below pre-pandemic levels, meaning that there will still be surplus capacity at the end of the year, albeit not a lot.

Many things could happen that will affect the price, such as:

Bullish:

Economic boom (enough to require all shut-in capacity returns to production). Unlikely, but could add another 2 mb/d by year’s end.

Middle East unrest, including:

Attacks on Saudi oil facilities: Likely but insignificant

Attacks on tankers: Possible but not very significant

Iran and/or Libya experience declines, taking 1-1.5 mb/d off market

Bearish:

New pandemic wave with lockdowns: Possible, could mean as much as 2 mb/d lower demand

Quota compliance slips and Saudis retaliate: Possible

More oil from Iran and/or Libya: up to 1.5 mb/d possible

U.S. shale production surges: Possible, maybe extra 1 mb/d by year’s end.

Overall, it seems that prices are more likely to be under downward pressure for the rest of the year than upwards.